Did you know the arena of self-directed retirement investing has recently been experiencing a shift? Investors have been moving in large numbers towards Checkbook Control plans which give them greater investment freedom at less of a cost!

Self Directed IRA investing was once dominated by custodian-based Self Directed IRAs. In a custodian-based model, an investor goes through his/her custodian for all investment transactions.

The Checkbook Control model puts the investing and transaction power back in the hands of the investor. Investments can be placed quickly in real-time and with no transaction fees, thanks to a Self Directed IRA with Checkbook Control (also known as a Checkbook IRA).

However, since the creation of Checkbook IRAs, a number of claims have come out questioning their legality and safety. We’ll explore the claims, see if there is any truth to them, and note the current legal guidelines as they apply to each point.

The Claim: Checkbook Control IRAs are illegal according to the IRS, and are considered one of the IRS’s “Dirty Dozen” tax scams.

The Truth: Checkbook IRAs, in fact, are legal! The Checkbook Control platform was given the green light by the U.S. Tax Court in Swanson v. Commissioner, 106 T.C. 76 (1996), and then confirmed by the IRS in Field Service Advisory (FSA) 200128011 (April 6, 2001).

The ability to add funds to a Checkbook IRA was approved by the Department of Labor in Advisory Opinion 97-23a. You can join the tens of thousands of investors who enjoy investing with the Checkbook Control platform today!

This claim stems from the IRS’s inclusion of “abusive retirement plans” on its 2011 “Dirty Dozen” list. The concern came from the possibility of engaging in “activity that is considered prohibited”. In other words, the Checkbook IRA platform is legal; the concern was that it could possibly lead to tax abuse in the form of prohibited transactions.

However, as the years have gone on, the vast majority of self-directed accounts are used responsibly and within the guidelines of tax law. As a result of this positive outcome, the IRS no longer lists “abusive retirement plans” on its “Dirty Dozen” list.

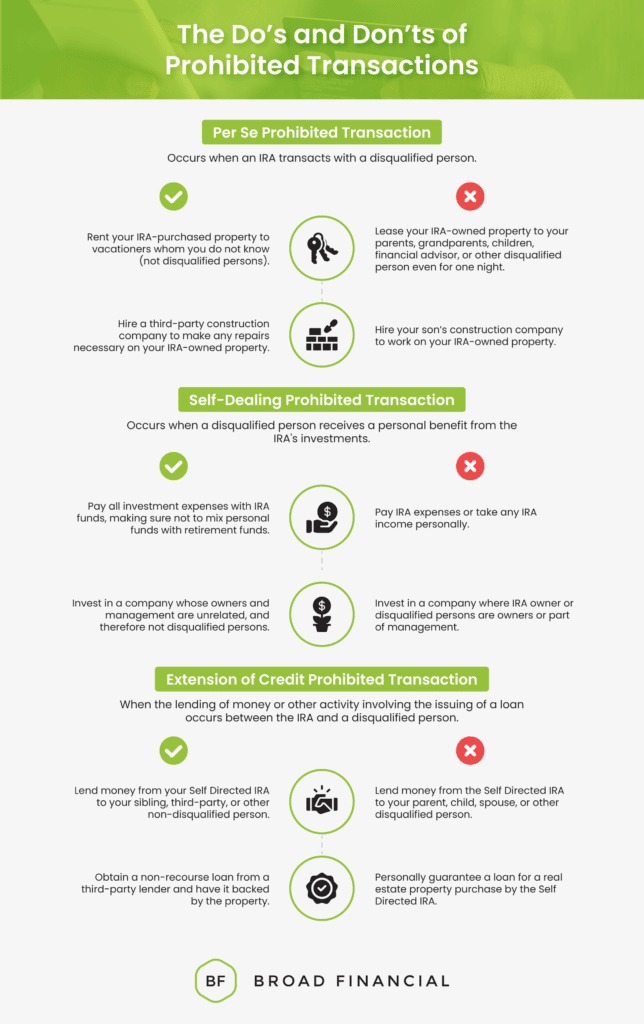

The Claim: Retirement funds can be put at risk if they are found to be engaging in Prohibited Transactions with a Self Directed IRA with Checkbook Control.

The Truth: Prohibited Transactions are part of the U.S. Tax Code, and apply to all retirement plans, including a Self Directed IRA with Checkbook Control. Self-directed accounts allow for greater investment freedom and could engage in committing a Prohibited Transaction.

In all cases, the responsibility of performing legal transactions lies solely on the shoulders of the investor. Neither the custodian nor the IRA facilitator takes responsibility for the legality of your investments.

However, bear in mind that this is not nearly as scary as it sounds. The few rules governing Prohibited Transactions are fairly simple to learn, and it’s incredibly rare that an investor will run into any trouble. Broad Financial’s dedicated client support team is here to guide you in the right direction. If any questions are more complex, we recommend reaching out to a CPA or attorney.

Now, you may be wondering, what are some Prohibited Transactions?

The Claim: Checkbook IRAs are an unsafe platform for investing in assets beyond Wall Street.

The Truth: Yes! Checkbook IRAs are 100% safe to invest with. Broad Financial’s Checkbook IRA platform has been crafted under the guidance of the country’s top ERISA (Employee Retirement Income Security Act) law firms.

To ensure your retirement funds stay in the green, all IRAs must be held by a Self Directed IRA custodian. Broad Financial works with our sister company, Madison Trust, for a seamless experience. Madison Trust sets up your Self Directed IRA and Broad Financial upgrades you to the IRA LLC to have checkbook control. For more information on the setup process, please visit the IRA LLC page.

The Claim: Checkbook IRA facilitators provide ongoing legal support.

The Truth: Here at Broad Financial, we do not promise ongoing legal support, just ongoing client support. Our Checkbook IRA Specialists are knowledgeable and ready to answer all of your questions. However, if we come across a unique question, we will refer you to an ERISA attorney to get more information.

Just like you expect your doctor to know how to address most health issues, and to refer appropriately when he/she doesn’t know the diagnosis, the same holds true with your self-directed facilitator. This setup ensures the quickest and most accurate information for you as the client.

Legal support can only be provided by legal professionals and is essential if legal action and advice are called for. The good news is all of Broad Financial’s Checkbook Control plans have been set up according to all relevant tax regulations. Your role as the investor will be limited to...investing!

Disclaimer – Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

The Claim: Checkbook IRA facilitators have control over your retirement funds.

The Truth: As a Checkbook IRA accountholder, you are in complete control of your retirement funds and investment decisions. A Self Directed Checkbook IRA gives you the freedom to invest in almost any alternative asset in real-time by simply writing a check or sending a wire from your designated checking account.

It is also important to note that no IRA model, self-directed or otherwise, insures the safety of your retirement funds. Although there are investments that may be safer, such as CDs and annuities, these will not have as much return on investment as those that involve more risk. As it is said, “with great risk often comes great reward”. An IRA by its very definition is an investment platform that allows for both profit and loss. Just as your IRA funds with a financial advisor or brokerage firm invest in the stock market that could rise and fall, your alternative investments with your Checkbook IRA can do the same. The growth of your retirement account depends on the performance of your investments.

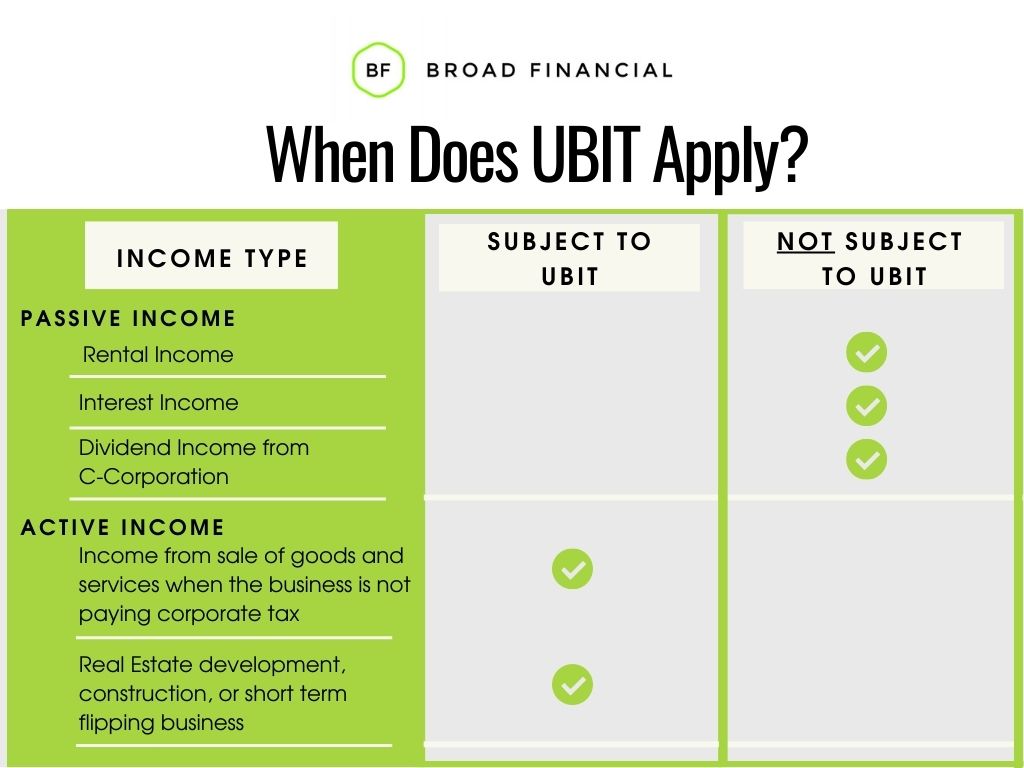

The Claim: A Checkbook IRA will expose your self-directed account to unnecessary business taxes such as UBIT.

The Truth: UBIT (Unrelated Business Income Tax) is a tax that is charged for running an active business as part of your retirement account.

For example, assume your IRA invests in a restaurant. When that restaurant makes a profit, that is active income and is subject to UBIT. On the other hand, you may decide not to invest in the restaurant, but instead invest in the real estate property that the restaurant is built on, hold it for years, and then sell the property. The capital gain received from the sale of the property is deemed passive income and does not incur UBIT. For more information and examples of when UBIT applies, please visit Information Alternative Investors Should Know About UBIT and Self Directed IRAs.

UBIT was created to level the playing field for traditional businesses not receiving the same tax benefits as your IRA.

The tax has absolutely nothing to do with the platform that you are using. If you invest in an active business, then you will be charged UBIT whether you invest with the Custodian Self Directed IRA or with the Checkbook model. Similarly, if you invest in a passive investment, you will not be charged UBIT on either platform.

The Claim: Some say that the Checkbook Control platform does not save you time when investing.

The Truth: Checkbook IRAs save you a lot of time. With Checkbook Control, the investment happens instantaneously in real-time by simply sending a wire or writing a check. There is no paperwork and no waiting for approval. It’s hard to get faster than that!

While the Self Directed IRA Custodians keep track of your IRA’s paperwork, being able to make investments without going through the Custodian will save you both time and money.

Claim: Checkbook IRAs are more expensive than Self Directed IRAs without Checkbook Control.

The Truth: To find out the fees related to all Self Directed IRAs, including Checkbook IRAs, all you have to do is ask for a fee schedule and compare the different platforms. You can find Broad Financial’s Checkbook IRA fees here.

The Custodian Self Directed IRA has a lower set-up fee (no LLC involved), and that fee is purely a function of the paperwork involved. However, Custodian Self Directed IRAs charge their clients for every single transaction. That means for every purchase, sale, maintenance activity, or anything else which would involve paperwork, the client must pay a fee.

Chances are if you are interested in using a Self Directed IRA, it’s because you have a specific alternative investment in mind. That kind of investment often involves ongoing account maintenance.

On the other hand, the Checkbook IRA’s fees at first come out looking hefty but a Checkbook IRA makes more economic sense in the long run. The Checkbook IRA format requires the establishment of a specialized LLC (a “Checkbook IRA LLC”).

The Self Directed Checkbook IRA LLC fees will therefore entail slightly higher start-up costs respective to the IRA LLC setup and all applicable paperwork (including the Checkbook IRA LLC Operating Agreement). This LLC is necessary as it is the tool that gives the IRA its Checkbook Control ability.

Although the Checkbook IRA is more costly to set up and does incur quarterly fees, once your IRA LLC is open and funded, you avoid expedited service fees and transaction fees. That means, no matter how many transactions you perform, you will never pay any fees to do so. The initial price will pay for itself many times over.

The Claim: Checkbook IRAs limit your investment choices.

The Truth: Unlike standard brokerage IRAs that typically limit accountholders to stocks, bonds, and mutual funds, Checkbook IRAs give you the freedom to invest in almost any asset of your choice. With a Checkbook IRA, you get to invest in assets you know and understand.

Common investments made with a Checkbook IRA include real estate (commercial, rental property, rehab-and-flip property, multifamily homes, etc.), tax certificates and deeds, and any other IRS-approved asset of your choice.

With the greater flexibility of asset choice, it is crucial to do proper due diligence. Research your investment thoroughly to make sure it is not prohibited by the IRS.

The Claim: It’s difficult to upgrade from a Custodian Self Directed IRA to a Checkbook IRA.

The Truth: There are many reasons why you may want to upgrade your Self Directed IRA to have checkbook control including no transaction fees, real-time investing, and superior liability protection. Luckily, upgrading your Custodian Self Directed IRA to the power of a Checkbook IRA is a fairly simple process.

If you have established a Self Directed IRA already at a custodian, you are ready to establish your IRA LLC to obtain the power of checkbook control. Luckily, Broad Financial makes the process simple so you can start investing and achieving your financial goals.

The first step is to complete a Broad Financial IRA LLC application. Next, we will establish a specialized LLC for your IRA and complete all LLC paperwork. Then, you will open a designated IRA LLC checking account at the bank of your choice and transfer your retirement funds to the checking account.

Once the IRA LLC and designated IRA LLC checking account are established and funded, you have the freedom and flexibility to invest in assets you choose by simply writing a check or sending a wire from your IRA LLC bank account!

When looking for an IRA LLC facilitator, it is best to identify your investment strategy and goals and do some research about which company is best suited to help you achieve these goals. The Better Business Bureau is a good first stop for information. You can find out more about customer satisfaction with various companies by checking their performance ratings on the Better Business Bureau (BBB).

Here’s a link to Broad Financial’s BBB page. Many of Broad Financial’s accountholders choose us for our low fees and exceptional customer service.

Here at Broad Financial, we believe that every investor should invest in what they know and do it in a way that makes sense to them. With Broad Financial’s Checkbook IRA you are given the freedom to do just that! If you have any further questions, please don’t hesitate to call us at 800.395.5200.

Schedule a call, and one of our Broad Specialists will answer any questions you may have.

SCHEDULE A CALLAddress:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST